A global giant in the automotive industry transforms its approach to return to the essentials

In the midst of the crisis facing the automotive industry in Germany, a global giant is making bold decisions to return to its roots. As the demand for new vehicles has plummeted and the growth of electric cars has stalled, leading brands are forced to reevaluate their strategies. This shift in focus translates into a return to what they do best, highlighting the importance of strengthening in their most profitable areas. In this context, the story of one of the largest producers of tires in the country reveals how adaptation and a reconcentration on fundamental aspects have become necessary measures to face the challenges of the current market.

The crisis in the automotive sector in Germany has led major companies to rethink their approach and return to the roots of their business. A clear example of this is Continental, the largest tire manufacturer in the country, which is reviewing its organizational structure and choosing to focus on what really brings it profits. This change comes at a time when sales of new vehicles are declining, adversely affecting suppliers and equipment manufacturers.

The decline in automotive sales

Since 2023, the crisis in the European automotive sector has worsened, with a notable decrease in the levels of new vehicle orders. Registration records have evidenced this decline, especially regarding electric cars, which have stopped growing. This situation has caused many suppliers, including giants like Bosch, ZF, and Schaeffler, to implement mass layoffs, seeking to refocus on their core activities.

The return to essentials by Continental

Continental has announced its intention to divest its ContiTech division, which is dedicated to the production of plastics and rubbers. “At this moment, Continental considers the sale of ContiTech as the most probable option,” sources within the company have indicated. This separation is expected to be formalized in 2026, subject to the approval of financial and regulatory markets.

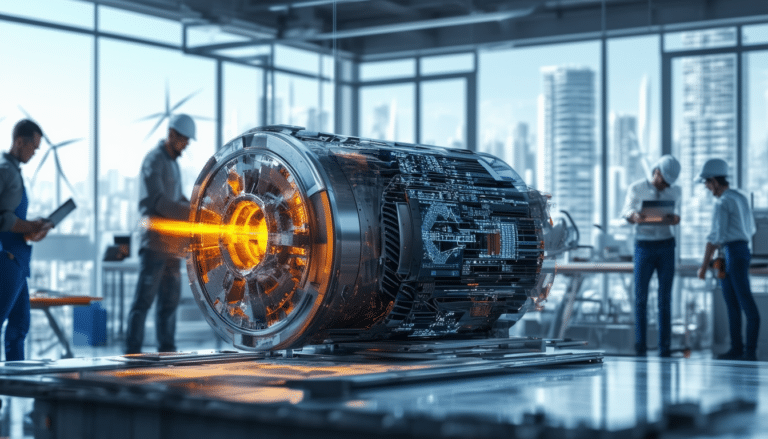

The profitability of tires

The tire sector remains the most profitable business unit for Continental, with a profit margin close to 14%. While other sectors have experienced significant declines in their revenues, the tire business has maintained its stability, prompting the company to refocus on this aspect of the market. Continental has also decided to cease the production of agricultural tires, thus consolidating its essence in the manufacturing of tires for road vehicles.

Impact on employment and uncertain future

Last year, Continental had already announced the elimination of 7,000 jobs, but the company has committed to maintaining employment in ContiTech until the end of 2026. After that point, the future looks uncertain for the nearly 40,000 employees of this division. The current market situation is driving Continental and other industry players to make tough decisions, prioritizing profitability over diversification.

As the automotive sector continues to face challenges, Continental’s strategy raises important reflections on the significance of returning to what is truly known and done well. Meanwhile, other manufacturers, such as Toyota and BYD, are paying attention to these transformations in an increasingly competitive and volatile environment.

Transformation towards essentials in the automotive industry

The crisis in the European automotive sector has led a global giant in the automotive industry to reevaluate its strategy and focus on its most profitable products. As new vehicle sales decline, the company has decided to return to its roots, concentrating its efforts on the production of tires, which have proven to be its largest source of income.

This reorientation includes the possibility of divesting less profitable divisions and eliminating redundancy in its operational structure. The reduction of jobs in other areas, such as the ContiTech division, reflects the need to maintain financial viability in a competitive market. Thus, the company is embarking on a transformation process, prioritizing innovation and efficiency in the tire sector.

This return to essentials is not only a strategic move, but also a response to market conditions that show that, even in difficult times, there will always be a demand for fundamental products.